Mississippians do better under the House’s Tax Freedom Act

Meet Betty and Jim. They each earn a salary of $40,000 per year. They each spend roughly $5,200 a year on groceries and $10,000 on items subject to the sales tax. Betty and Jim each pay $600 a year for their car tags.

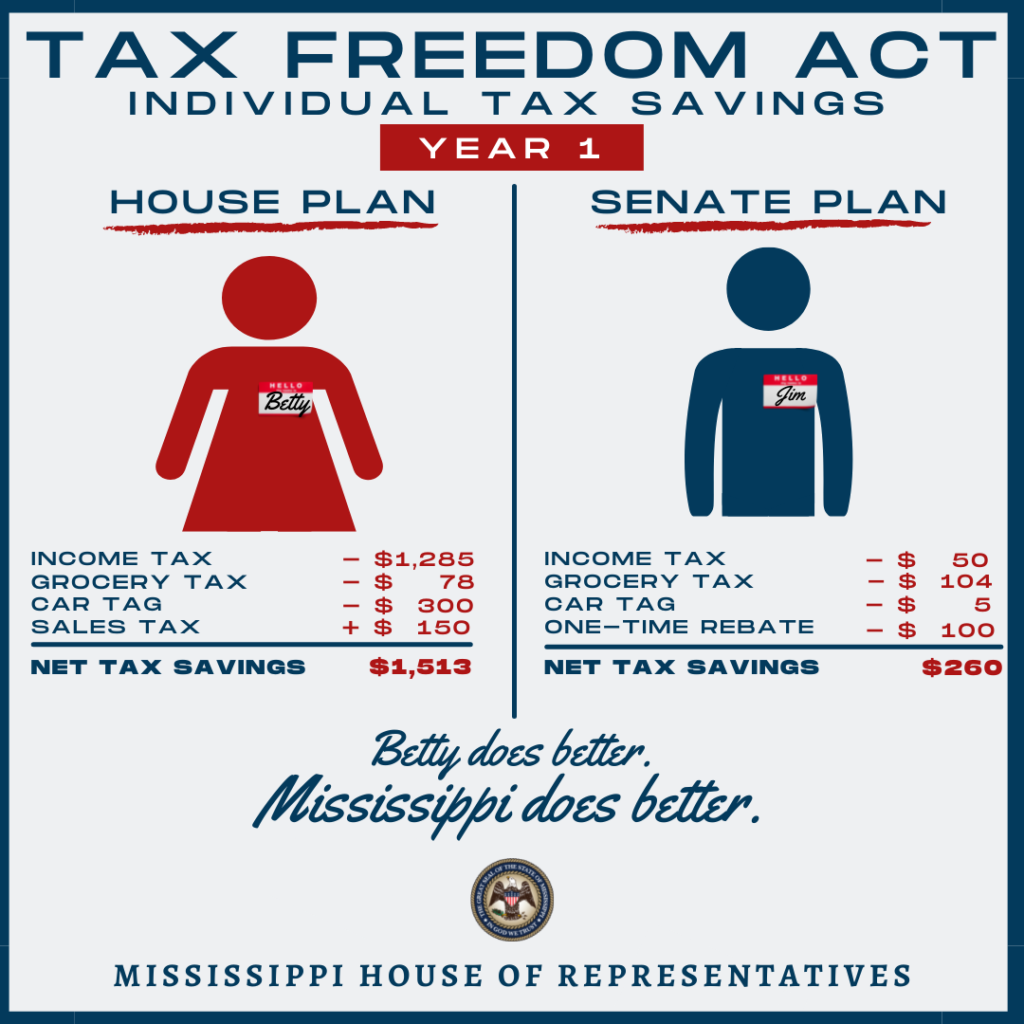

Under the House’s Tax Freedom Act, Betty’s income tax is cut by $1,285. Betty’s grocery tax is reduced by $78. While her sales tax goes up by $150, Betty’s car tag is cut in half, saving her $300. Betty saves $1,513 in the first year of the House’s tax plan.

Jim, however, pays his taxes pursuant to the Senate tax plan. While Jim saves $104 in grocery taxes and gets a one-time rebate of $100, the Senate plan only cuts his income tax by $50 and his car tag by $4. Jim saves $259 in the first year.

Under the House plan, Betty does better. Mississippi does better.

Ask your Senator to work with the House to eliminate the income tax, cut the grocery tax and provide real relief on car tags.

Comments are closed.